A number of technologies promise so much, but have so far delivered rather little. Fuel cells have been about to change the face of energy storage for decades, yet are still rare in real world applications. Nuclear fusion has remained, stubbornly, 20 years away from commercial reality for the last 40 years. Nanotechnology may be omnipresent in electronic devices, and creeping into everyday life in other fields such as medicine, but has yet to fulfil the promise of so much science fiction.

Then there is the world of MEMS and MOEMS, the technology of the not-quite-nano, which has all the potential to be just as disruptive to everyday life as the microelectronics revolution has been – yet that potential remains stubbornly unfulfilled. MEMS and MOEMS devices may have become common, but their application and recognition are both limited and their impact has been rather subtle.

There are signs, though, that this may be about to change – and the potential for disruption in a number of industries is as large as the devices are small.

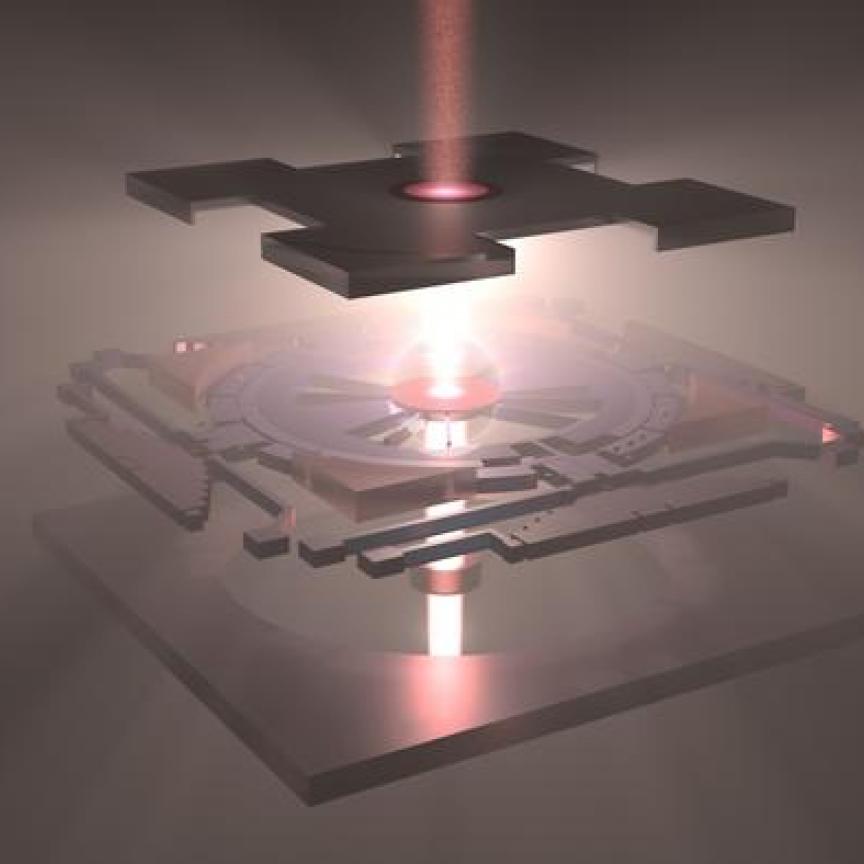

MEMS are micro-electrical-mechanical systems, which incorporate tiny moving mechanical components coupled with microelectronics, while MOEMS are micro-optical mechanical systems that add optics into the mix. Both exist in the scale range between conventional machinery (some might class traditional watchmaking as an early example of MEMS) and the near-invisible world of nanotech.

For most people, these are completely unknown technologies – despite the fact that just about everybody carries a number of MEMS devices with them every single day. The accelerometers, gyroscopes, and compasses in a smartphone are all MEMS, as are inkjet print heads, while digital projectors are MOEMS devices that now illuminate the majority of cinema screens.

Although they may have quietly become commonplace, for many in industry they still promise much more than they have delivered. Manufacturing has presented a number of technical challenges that have proved harder to solve than in the parallel world of microelectronics, and this has meant that factory-gate prices have not fallen as quickly. There is no equivalent of Moore’s Law in the world of MEMS and MOEMS.

As a result, potential applications such as new types of sensors and analytical instruments have remained largely that – potential. Both costs and risks have remained high, while applications have appeared limited, making it difficult to secure the investment needed to build the plant to make the things cheaply enough to take the market by storm.

It’s a vicious circle that has hampered the sector for the last couple of decades, but there are signs that these are technologies whose time has finally come.

Think small

There is certainly no shortage of ideas for ways to exploit these mini-micro-machines. Microfluidic chips incorporating valves, reaction vessels, sensors and pumps have already made inroads into medical diagnostics, and could revolutionise the synthesis of chemicals. Cameras built with MOEMS are small enough to be swallowed and can transmit live pictures from the gut, while cardiac pacemakers could become self-powered through energy-harvesting MEMS such as those being developed by the Smart-Memphis project.

Many classes of laboratory instrument have the potential to be shrunk to pocket-sized, or incorporated into multi-functional handheld devices resembling, (or perhaps actually being) mobile phones. The word ‘tricorder’ is frequently bandied about in this context, often accompanied by a rueful shaking of the head by those who’ve heard it all before. Meanwhile, the much-hyped Internet of Things relies heavily on the ability to ‘smarten-up’ otherwise mundane objects through the incorporation of sensors, actuators, and digital communications.

What’s stopping all this happening? While photolithography techniques have steadily reduced component sizes and costs for solid-state microelectronics, the mechanical and optical components required on MEMS and MOEMS devices have presented a number of engineering challenges.

‘There are probably many factors that limit the rate of adoption of the technology, and one of those is certainly the difficulty of setting up production,’ explained Dr Veljko Milanovic, founder and CEO of Mirrorcle Technologies, which offers a variety of optical MEMS products.

He continued that integrated circuit (IC) and mobile device manufacturing technologies and ecosystems are generally not accessible for smaller volumes. ‘In the sense that optical MEMS devices – and specifically MEMS mirrors – are considered silicon or semiconductor products like IC chips, there is going to be a huge disconnect between expectations and availability,’ he said. ‘They simply cannot be measured in cents per millimetre squared metrics and such discussions typically signal an impasse. On the other hand, in the sense that MEMS mirrors are considered as photonics devices which require a multi-dimensional mix of solutions to be made and supported, they should be highly attractive for a growing number of new product designs.’

The conventional answer to overcoming barriers to entry in the MEMS and MOEMS market is to contract manufacturing out to a dedicated foundry. Claiming to be the largest ‘pure play’ MEMS foundry in the world, Silex started with a six-inch wafer manufacturing facility capable of 400,000 litho moves per year, and has since added an eight-inch fab with a further 500,000 annual moves.

While any MEMS foundry will offer cast iron guarantees that the developer’s intellectual property will be protected, the high cost of MEMS development and the secretive nature of manufacturing processes mean that there can be some reluctance to involve any third party. MEMS products may sell for a couple of dollars each and, as with microelectronics, the only pressure on prices is downwards, so their value lies almost entirely in their IP. When GPS receivers can be incorporated into mobile phone circuits for a few pennies, it won’t be long before the same is true of accelerometers and gas sensors.

What is needed in order to make a viable business out of MEMS technology are new manufacturing techniques that can produce huge numbers of products, quickly and reliably, for moderate capital investment, and preferably offering manufacturing versatility to cope with unknown future technological developments.

That is a tall order, but is one that a number of recent initiatives and developments has brought closer.

MEMS for the SMEs

A European initiative to lower MEMS manufacturing costs to within the reach of small- and medium-sized businesses, Smarter-SI aims to bring together academic research from across the continent with existing manufacturing expertise in the production of mechanical and optical microsensors and microcomponents.

Seven research institutes from Germany, Switzerland, Spain, Ireland, and Sweden, with seven manufacturing businesses, have the ambitious goal of creating a common production platform and a sustainable collaborative business model. Its intention is to offer SMEs production facilities for state-of-the-art microsystems in small quantities, at an economical price, without lengthy development periods.

Seeded with €5.3 million of EU funding, the project aims to have its collaborative platform operating by 2018 at the latest.

‘We have a unique portfolio of high technology components and subsystems ready for use,’ said Smarter-SI CEO Professor Thomas Ortlepp. ‘We want to share this competitive advantage with SMEs to develop products quickly, and of the required high quality.’

Among the early products are: a maintenance-free carbon dioxide measuring device; a self-powered dew-point measuring system for applications in freeze-drying and process control; and a robust pressure sensor for harsh environments, based on a silicon strain gauge and ceramic membrane. A point-of-care device for testing food allergens and a condensation monitor to protect sensitive electronics are also on the slate.

Smarter-SI is one of the European Commissions’s flagship projects for its bafflingly-named ‘Smart Anything Everywhere’ initiative to boost high-tech manufacturing.

Last year saw the launch of the second wave of another European-focused research project, seeking to accelerate the development of next generation MOEMS technology. The original Lab4Mems project launched in 2013, concentrating on micro-electro-mechanical developments, but Lab4Mems II is aimed squarely at optical and photonics aspects of the technology.

Like its sister project, Lab4Mems II is a public-private partnership from the European Nanoelectronics Initiative Advisory Council (ENIAC).

Funded to the tune of €26 million, the project has 20 industrial, academic, and research partners in nine European countries. It is coordinated by semiconductor and device manufacturer, STMicroelectronics.

The project concentrates on the design, fabrication, and testing of devices including optical switches, micro-mirror arrays, optical cross-connects, lasers, and micro lenses using micro-optics and micromachining to miniaturise and build advanced optical systems. One specific goal is to optimise the production of dual single-axis mirrors, and to research the potential for single dual-axis mirrors.

The pilot production line will expand volume production at ST’s existing 200mm wafer fab at Agrate Brianza, Italy, while adding optical technologies to the mix. It will also evaluate the potential benefits and impact of a mooted future move to 300mm wafers.

99 per cent price crash

For some researchers, the way to really unlock the potential of MEMS and MOEMS is to throw away everything we think we know about manufacturing, and start again. Those expensive semiconductor manufacturing facilities are so ‘20th century’, and may be about to be overtaken by desktop-sized machines exploiting the very MEMS and MOEMS technology they create.

Two recent publications from the Massachusetts Institute of Technology’s (MIT) microsystems technologies laboratories seem to hold much promise. The first shows that a MEMS-based gas sensor built with a desktop device performs ‘at least as well’ as sensors built by conventional techniques, and the second shows that the critical component of the desktop MEMS maker can itself be created with a 3D printer.

Principal research scientist Luis Fernando Velásquez-García said that, together, these developments mean that a widely used MEMS gas sensor could be produced at one-hundredth the cost with no loss of quality.

The desktop device employs dense arrays of emitters, which eject microscopic streams of fluid when subjected to strong electric fields. Working with Anthony Taylor, a visiting researcher from Edwards Vacuum, Velásquez-García sprayed fluid containing tiny flakes of graphene oxide onto a silicon substrate, creating a predetermined pattern.

The graphene flakes are so thin that interaction with gas molecules changes their resistance in a measurable way: bingo, a gas sensor. ‘We ran the sensors head to head with a commercial product that cost hundreds of dollars,’ said Velásquez-García, ‘and showed that they are just as precise, but faster.’

He reckons the production cost is extremely low, ‘probably cents’, for something that works at least as well as existing commercial sensors.

Disruptors come to market

What works for gas sensors will work for all manner of other devices, according to industry insiders. For while MEMS and MOEMS may have so far delivered more promise than punch, that all looks about to change.

The market for spectrometers is likely to be an early testing ground for the new paradigm of cheap, tiny, high-performance instruments, said Dr Nick Barnett of distributor Pro-Lite Technologies. He cites several promising-looking devices now making their way to market, including products from established players such as VTT, as well as a new breed of upstart start-ups that leverage the crowdfunding culture.

What they have in common is the potential to make existing instrument manufacturers look slow, expensive, and out of touch. Where a conventional spectrometer might cost anything between £12,000 and £20,000, devices now becoming available promise to do the same job for about one-tenth of that.

Dr Barnett thinks that the industry will see a big shake-up in the near future: ‘This technology is disruptive, and companies that exist to sell old technology devices need to be aware. It will be difficult for some of them to continue.

‘I think the time has come. Spectrometers, particularly near-IR devices, will soon fit on a mobile phone or pocketable widget. It’s going to take off now.’

Compared to the global semiconductor industry, which has annual sales of about $330 billion, the MEMS sector remains the little brother. Global sales were between $11 and $12 billion in 2014, but are forecast to grow strongly over the next few years.

Grand View Research published its market analysis of the sector in March 2016, predicting that the global MEMS market would more than double over the next six years, reaching sales of $26 billion by 2022. The biggest product areas are expected to be consumer electronics and healthcare.

An interesting detail in these predictions is that less than a quarter of the global market will be in the USA. In semiconductors, the USA consistently accounts for about half of all sales.